The cost of living in Ireland covers many expenses like housing, utilities, groceries, and transport. It’s key to know these costs if you’re thinking of moving or visiting. Inflation and where you live affect these costs a lot. This guide will help you understand what to expect.

We’ve used reliable sources to give you a clear view of living in Ireland. This will help you plan your budget better.

Key Takeaways

- The overall cost of living in Ireland varies significantly by region.

- Housing is one of the largest components of the living expenses.

- Utilities and groceries also contribute substantially to monthly budgets.

- Transportation costs differ between urban and rural areas.

- Healthcare expenses can be higher in private systems compared to public services.

- Education and childcare are significant factors for families moving to Ireland.

- Understanding local market trends is crucial for an accurate Ireland cost comparison.

Introduction to the Cost of Living in Ireland

For expatriates, students, and residents, knowing the cost of living in Ireland is key. This introduction to living costs covers various expenses that affect daily life. It’s vital for making a detailed budget in Ireland.

Many factors affect living expenses. Daily needs like food, housing, and transport are big parts of the budget. Choices about eating out or leisure activities also play a role. Finding a balance between living well and saving money is important.

An Ireland financial overview shows some costs are higher, while others are lower compared to other European countries. For example, city housing costs can be more than in rural areas. Knowing these differences helps understand Ireland’s living costs better.

Looking at historical trends and the economy’s current state also shapes costs. By understanding these, people can better manage their money in Ireland.

Comparative Analysis of Living Costs in Europe

Living costs in Europe vary a lot from one country to another. This shows the different economic situations and lifestyles. Ireland is among the more expensive countries, but it’s good to look at costs in relation to other European countries.

Things like average salaries, house prices, and the cost of everyday items are key in comparing living costs in Europe. Countries in Eastern Europe often have lower living costs. On the other hand, places like Switzerland and Norway have higher costs. This affects how affordable Ireland is compared to these countries.

| Country | Average Monthly Salary (EUR) | Cost of Living Index |

|---|---|---|

| Ireland | 3,500 | 82 |

| Germany | 3,200 | 73 |

| France | 3,000 | 74 |

| Spain | 2,500 | 65 |

| Italy | 2,800 | 68 |

| Sweden | 3,400 | 77 |

Ireland has a good average salary but its cost of living index shows its position in Europe. Regional differences within Ireland add to the complexity of living costs. It’s vital for both newcomers and residents to grasp these details.

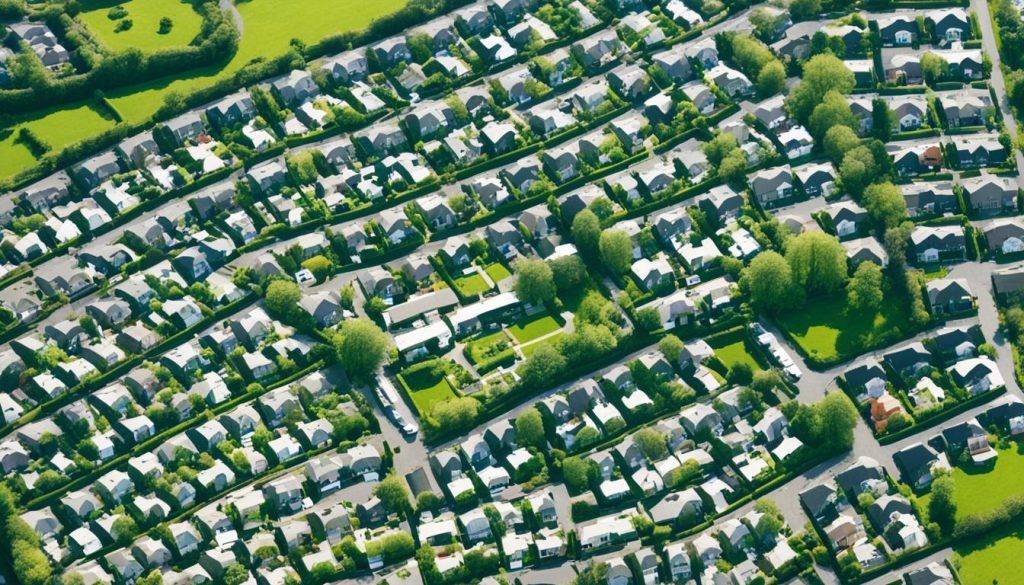

Housing Expenses in Ireland

The cost of housing in Ireland is a big part of the overall living expenses. This section looks at the average rent prices in big cities and the costs of buying property. It gives useful info for those thinking of moving or investing in the Irish property market.

Average Rent Prices in Major Cities

Rent prices in Ireland have changed a lot, especially in cities. The Central Statistics Office shows that cities like Dublin, Cork, and Galway have different rent trends:

| City | Average Rent Price (Monthly) |

|---|---|

| Dublin | €2,200 |

| Cork | €1,600 |

| Galway | €1,500 |

These figures show the big challenge Ireland faces with housing costs, especially in Dublin. The high demand for rentals keeps pushing prices up. This makes finding affordable housing hard for many people.

Property Purchase Costs

The property market in Ireland offers different choices for buyers. Recent figures show that house prices vary a lot by location:

| City | Average Property Purchase Cost |

|---|---|

| Dublin | €500,000 |

| Cork | €350,000 |

| Galway | €330,000 |

Knowing these numbers is key for potential buyers. With more people interested in different areas, buyers need to be careful. They must navigate the property market well to get the investment they want.

Utilities and Monthly Bills

Understanding utility costs is key to managing household expenses. Monthly bills for electricity, gas, and water can greatly affect a family’s budget. This section looks into the average costs of Ireland’s electricity prices and other utilities. It also compares internet and mobile phone plans across the country.

Average Electricity and Gas Costs

In Ireland, monthly bills for electricity and gas change based on how much you use and the prices set by providers. Prices can go up and down due to market changes and the seasons. On average, a household pays about €130 a month on electricity and around €100 on gas.

These costs can change based on the size of your home and how energy-efficient it is.

Internet and Mobile Phone Plans

In Ireland, there are many options for internet and mobile phone plans from big providers. Prices for broadband usually range from €30 to €60 a month, depending on how fast it is and how much data you get. Mobile phone plans also vary a lot.

Basic plans start at about €20 a month, while full-featured plans can go up to €70. This covers different needs for using your phone.

| Service | Average Monthly Cost (€) | Provider Examples |

|---|---|---|

| Electricity | 130 | Electric Ireland, Bord Gáis Energy |

| Gas | 100 | Flogas, SSE Airtricity |

| Broadband | 45 | Eir, Virgin Media |

| Mobile Phone | 45 | Three, Vodafone |

Grocery Costs and Food Prices

Knowing what groceries cost is key to understanding living costs in Ireland. Surveys by consumer groups show us the prices of everyday items. This gives us a clear picture of what food costs for people living here. Items like bread, milk, and meat are key to weekly budgets.

Essential Grocery Items

This table shows the average prices of must-have groceries in Ireland. It helps consumers see what they might pay for these items:

| Item | Average Price (€) |

|---|---|

| Bread (500g) | 1.50 |

| Milk (1 litre) | 1.10 |

| Chicken fillet (1kg) | 8.00 |

| Eggs (12) | 3.00 |

| Potatoes (1kg) | 1.20 |

When thinking about food costs in Ireland, people often add up their weekly shopping. Knowing these prices helps families plan their budgets better. It lets them decide where to spend their money.

Dining Out and Takeaway Expenses

Eating out is another part of food spending in Ireland. Here’s how much you might pay for meals out and takeaways:

| Meal Type | Average Price (€) |

|---|---|

| Three-course meal for two at a mid-range restaurant | 60.00 |

| Fast food combo meal | 8.00 |

| Takeaway pizza | 12.00 |

| Coffee at a café | 3.50 |

| Bottle of beer at a pub | 5.00 |

The tables show that eating out can cost a lot or a little. This gives people different choices based on their budget. Knowing these costs helps people make better food choices and plan their lives.

Transportation Costs in Ireland

In Ireland, people have many ways to get around, leading to different costs. It’s key to know these costs, especially in cities where travel costs can add up fast.

Public Transport Expenses

Public transport includes buses, trams, and trains. There are various fares to help manage travel budgets. Prices change depending on where you are and how far you travel. Many cities use a zoned system, which changes the cost of each trip.

Monthly passes are cheaper for those who travel often, lowering the cost per trip. Here are some options:

- Single fares: €2.00 to €3.50, depending on distance.

- Daily passes: €8.00 to €12.00.

- Monthly passes: €120.00 to €150.00.

Car Ownership Costs

Having a car in Ireland brings its own set of costs. These include fuel, insurance, road tax, and maintenance fees. Each cost is important for planning your transport budget.

Here’s a look at typical car ownership costs:

| Cost Type | Average Cost (per month) |

|---|---|

| Fuel | €150.00 |

| Insurance | €100.00 |

| Road Tax | €20.00 |

| Maintenance | €50.00 |

When thinking about travel costs, consider the pros and cons of public transport versus car ownership. Choosing wisely can help save money while still meeting your needs.

Healthcare Costs in Ireland

In Ireland, the healthcare system has both public and private parts. The public system is mainly funded by taxes. It helps those who can’t afford medical care. But, some treatments might still have extra costs, adding to the overall healthcare expenses.

Public vs. Private Healthcare Expenses

The public health system in Ireland covers many basic services. This includes visits to the hospital and GPs for those with a medical card. However, waiting for treatment can be long, pushing many towards private healthcare.

Private healthcare means quicker treatment but at a higher cost.

| Healthcare Service | Public System (Approx. Cost) | Private System (Approx. Cost) |

|---|---|---|

| GP Visit | €50 (with medical card may be lower) | €70 – €100 |

| Hospital Admission | €80 per day for inpatients | €2,500 – €10,000 (depending on the procedure) |

| Specialist Consultation | €100 (may be covered for certain cases) | €150 – €300 |

Insurance Premiums

Private insurance prices change based on the coverage and provider. Insurers offer different plans for various healthcare needs. It’s important to compare these options to find a good balance between coverage and cost.

The average yearly premium for private health insurance in Ireland is between €1,200 and €2,500. This depends on the person’s age and health. It’s key to think about the benefits of private insurance and its costs to make smart healthcare choices.

Education and Childcare Expenses

For families planning for their children’s future, understanding education costs in Ireland is key. School fees differ between public and private schools. Public schools are free, but parents might pay for uniforms, books, and extra activities. Private schools charge fees from €3,000 to €15,000, based on the school’s standing.

Childcare costs are another big expense for families. Monthly fees for childcare can be as high as €1,200 for babies, dropping for older kids moving to preschool and primary school. Parents look at crèches, home care, and childminders, each with their own costs and perks.

Some government schemes help ease the load of education costs in Ireland. The Early Childhood Care and Education (ECCE) programme offers free preschool to kids aged three to six. This lets families save on childcare while giving their kids top-notch early education.

Here’s a quick look at typical school and childcare fees in Ireland:

| Type of School/Childcare | Annual Fees/Costs |

|---|---|

| Public Primary School | Minimal costs (uniforms, materials) |

| Private Primary School | €3,000 to €8,000 |

| Public Secondary School | Minimal costs (activities, materials) |

| Private Secondary School | €5,000 to €15,000 |

| Childcare Facility (infants) | €12,000 annually |

| Childcare Facility (toddlers) | €10,000 annually |

| Preschool (ECCE programme) | Free for eligible children |

When planning budgets, families should look closely at these costs. This way, they can make sure their kids get the right schooling and care.

Leisure and Entertainment Costs

Knowing about leisure expenses in Ireland is key for anyone planning their budget. Entertainment costs can change a lot based on what you do. From going to the cinema to attending cultural events, prices can add up fast. It’s important to think about these costs when you’re planning your budget.

Average Costs for Activities and Outings

There are many activities to choose from, and their prices show the variety. Here’s a table with typical leisure activities and their average costs in Ireland:

| Activity | Average Cost (€) |

|---|---|

| Cinema Ticket | €12 |

| Theatre Show | €30 |

| Concert Ticket | €55 |

| Outdoor Pursuits (Hiking) | €0 – €15 (depending on location) |

This table shows the different costs people in Ireland might face when enjoying leisure activities.

Gym Membership and Wellness Expenses

Gym memberships are a big part of leisure spending for many. In big cities, gym membership prices can vary a lot. Here’s a look at average monthly gym fees:

| Gym Type | Average Monthly Cost (€) |

|---|---|

| Basic Gym | €30 |

| Mid-Range Gym | €50 |

| Premium Fitness Club | €80 |

| Yoga or Pilates Class | €15 per class |

Investing in fitness memberships and wellness activities can really improve your health. But, they are a big part of what you spend on entertainment.

The Cost of Living in Rural vs. Urban Areas

The cost of living in Ireland changes a lot between rural and urban places. This affects many people’s lifestyle choices. Urban areas usually have higher living costs than rural ones. This is because of things like housing, transport, and food prices.

Housing is a big difference in costs between rural and urban living. In cities, rent and property prices are often higher because of demand. This makes life more expensive for many people. Rural areas, however, have cheaper housing, which helps people save money for other things.

Transport costs also play a big part in living expenses. City dwellers often use public transport, which can be pricey. But, those in rural areas might use their own cars. This can be cheaper if they watch fuel prices and maintenance costs.

Food prices also affect the cost of living. City supermarkets charge more because of their high costs. But, in rural areas, shops might sell things cheaper. Buying local products can help save money and support local businesses.

In short, living in rural or urban areas changes the costs a lot. Knowing these differences helps people make better choices for their money.

| Cost Factor | Rural Areas | Urban Areas |

|---|---|---|

| Average Rent | €800/month | €1,500/month |

| Public Transport | €50/month | €120/month |

| Grocery Costs | €200/month | €350/month |

| Commute Distance | 5 km | 15 km |

Is it expensive to live in Ireland?

Living in Ireland has its costs, which depend on many factors. These include housing, utilities, and everyday expenses. Some places in Ireland are pricier than others, making the cost of living complex.

Housing costs a lot, especially in cities like Dublin. Rent prices have gone up a lot, making it harder for new people to move in. People need to think about their salary when looking at these costs. In some places, salaries are high enough to cover the living costs, making life balanced.

Utilities and basic costs add to the cost of living in Ireland. Bills for things like electricity, gas, and internet can add up fast. For families, childcare and school fees can also be a big expense.

So, some might think Ireland is too expensive, but others see the good life, culture, and job chances as worth it. It’s important for people thinking of moving to Ireland to look at their own finances. This way, they can see if the benefits fit their needs and lifestyle.

Influence of Location on Living Costs

In Ireland, living costs vary greatly between urban and rural areas. Cities like Dublin and Cork have higher prices for housing, food, and services. This means people and families must think carefully about where to live.

Cost Differences Between Cities

Looking at city living costs shows how important population density and local economy are. Dublin’s high demand for housing makes it pricier. Yet, places like Limerick or Galway offer more affordable living. Jobs and wages in these areas also affect what people spend on daily items.

Factors Affecting Local Prices

Many things affect prices in Ireland. Local demand and tourism can push up costs in certain areas. It’s important to understand these factors for budgeting and lifestyle in different places.

FAQ

What is the average cost of living in Ireland?

Living costs in Ireland change a lot depending on where you live. Dublin is the priciest city. You might spend €1,800 to €2,500 a month on rent, bills, food, and transport.

How do housing costs compare in different cities?

Housing prices in Ireland vary a lot. For example, a one-bedroom flat in Dublin can be over €2,000 a month. But in cities like Cork or Galway, it’s around €1,200 to €1,800. This shows the big difference between city and country living.

What are the typical utility costs for an average household?

Utilities like electricity, heating, and water cost about €150 to €250 a month. The exact cost can change based on how much you use and who supplies it.

Are grocery prices higher in urban areas?

Yes, groceries are more expensive in cities than in the countryside. For a small family, you might spend €60 to €120 a week on basics like bread, milk, and meat.

What are the best options for public transport in Ireland?

Ireland has good public transport like buses, trains, and trams. Single fares vary, but a monthly pass costs between €120 to €160. This depends on where you live, so it’s important to plan your travel budget.

How does healthcare work in Ireland?

Healthcare costs can vary a lot. Public healthcare is often free or cheap for those who qualify. But private care can be expensive, with insurance premiums up to €1,000 a year.

What are the education costs for children in Ireland?

Education costs differ a lot. Public primary schools are free, but secondary schools can cost €300 to €1,500 a year. Childcare for young kids can also be over €1,000 a month.

What recreational activities are available and what are the costs?

Ireland has lots of fun activities. Movie tickets are about €12 to €15. Gym memberships are from €30 to €70 a month, depending on the place and type of gym.

Is it more expensive to live in urban areas compared to rural regions?

Yes, city living is usually more costly than country living. This is due to things like housing, transport, and lifestyle options. It’s important to think about your lifestyle when moving.

How can I estimate my budget in Ireland effectively?

To budget well in Ireland, think about housing, bills, food, and transport costs. Also, consider your income and lifestyle to keep your finances balanced.