Starting a business in Ireland can bring both good and bad aspects. Ireland is known for its easy-going business laws, good tax rules, and skilled workers. It’s a tempting place for UK investors to start a business. Companies in Ireland can also protect their shareholders’ assets through a limited liability structure.

The country offers competitive tax benefits, like low company taxes, which are attractive to businesses. Companies in Ireland operate independently, making contracts and legal tasks easier. Still, setting up and running a company there can be pricey and complicated due to more laws for directors.

Ireland requires companies to be open about their activities, which might be more than other places ask for Despite the hurdles, Ireland provides a smooth process for setting up companies, various company types, and business-friendly laws. The tax breaks, especially for research and development, also appeal to UK investors looking at Irish opportunities.

Key Takeaways

- Limited liability structure in Ireland protects shareholders’ personal assets.

- Competitive tax efficiencies and lower corporate tax rates.

- Higher setup and maintenance costs for business establishment in Ireland.

- Public disclosure requirements enhance transparency but add complexity.

- Favourable environment with business-friendly laws and taxation, especially for R&D.

Introduction to Setting Up a Company in Ireland

In recent years, Ireland has become a top choice for business, especially for UK entrepreneurs wanting to grow. The process to start an Irish business is smooth, thanks to quick company registration in Ireland and friendly tax rules. This guide will help investors by explaining how to set up a company in Ireland.

To start, you must pick a company name that respects local rules. Next, you choose company directors, as per Irish law. A key step is finding a registered office address in Ireland. This address will be where your company gets official mail and handles legal stuff.

Ireland is a key spot in Europe, giving businesses great access to the EU market. Its advanced legal and tax systems offer a strong base for new companies. This encourages growth and lets new ideas flourish.

UK businesspeople looking to benefit from Ireland’s welcoming business scene should understand limited liability. This protects personal wealth and helps with the company’s ambitious plans. With this guide, you’ll get a full picture of the process. From starting up to running your business in Ireland, everything is made clear.

Ireland’s favourable tax laws and a globally recognized talent pool make it even more attractive. For investors exploring their options, understanding how to easily start a company in Ireland is key. This detailed method helps in embarking on the challenging but rewarding path of establishing a new business in Ireland.

Advantages and Disadvantages of Company in Ireland

Starting a company in Ireland brings both perks and challenges. Knowing these is key for anyone looking to invest here. Let’s explore what to consider.

Limited Liability

One great benefit of setting up a Limited Company in Ireland is limited liability. This ensures your personal wealth is safe if your business doesn’t make it. Many investor types find this appealing for safe and varied investing.

Tax Efficiency

Ireland boasts a great tax setup for businesses. With low corporate tax rates, it’s a magnet for local and overseas entrepreneurs. LTD companies get to enjoy even better tax conditions, leading to cost savings and more profits.

Separate Legal Entity

Creating a company in Ireland makes it a separate legal being. It can make deals, own things, and go to court by itself. This separation is good for reducing risk and adding to the business’s structure.

Raising Investment

In Ireland, Limited Companies can gather funds by selling shares. This method is excellent for enhancing business finances and supports growth and development.

Though Ireland is enticing, running a company there has its responsibilities. Irish company heads must follow many rules and report lots. This means more work and costs, which requires good planning and handling.

Public Information

It’s also important to know that in Ireland, company info is open to the public. The law says that financial records and director identities must be out there. Some might see this openness as a downside, wanting more privacy instead.

Before diving in, entrepreneurs and investors should carefully think about these points. Finding the right balance can pave the way for success in Ireland’s lively business environment.

Ease of Company Formation in Ireland

Starting a business in Ireland is straightforward, offering an easy path for budding entrepreneurs. One key benefit is the minimal bureaucracy, making the whole process fast, often within weeks. This quick and efficient way to register a company in Ireland is highly valued by those eager to get their business up and running.

Ireland’s approach to company formation benefits business owners greatly. It’s designed to be easy, allowing for a quick start without too much paperwork or delays. This makes it very appealing to companies wanting to quickly step into the market.

Also, changing the company structure in Ireland is straightforward. This means businesses can easily adapt to new market conditions. Such flexibility is crucial for any startup in Ireland, especially for UK companies looking to grow internationally.

- Minimal bureaucracy ensures quick registration

- Streamlined processes reduce paperwork

- Flexibility in altering company structure

In summary, Ireland offers significant advantages for starting a business, emphasizing ease and efficiency. With a system that favours user-friendliness, Ireland leads globally in company formation, attracting worldwide business interest.

Tax Benefits of Incorporating in Ireland

Setting up a company in Ireland offers great tax benefits. This is because Ireland has a friendly business climate and a strong tax system. These factors draw many international businesses to the country.

Competitive Corporate Tax Rate

Ireland is known for its low corporate tax rate. At just 12.5%, it’s among the lowest in the European Union. This rate helps businesses big and small save on taxes. Even if it rises to 15% for bigger companies, it’s still considered low.

Double Tax Treaty Network

Ireland has made more than 70 double tax treaties. These treaties help to prevent double taxation, making international business smoother. By using these treaties, companies can avoid being taxed twice on the same income.

Section 110 Regime

The Section 110 regime provides tax benefits for some financial transactions. It enables tax neutrality for these transactions. It’s important to keep up with changes that could affect these benefits, though.

All these tax advantages make Ireland a top choice for companies. They highlight why many aim to base their tax strategies in Ireland.

How to Set Up a Private Limited Company in Ireland

Starting a private limited company in Ireland is pretty easy but needs you to be exact. Here’s a guide to walk you through setting up your Irish private limited company:

- Choosing and Registering a Company Name: Make sure the name you pick is unique and fits the Companies Registration Office (CRO) rules.

- Appointing Directors: You should have at least one director who’s over 18 and not bankrupt. Also, one director must live in the EEA, unless you have a Section 137 Bond.

- Designating a Company Secretary: Choose a trustworthy person or company as your company secretary. They’ll make sure your company follows the rules.

- Setting the Registered Business Address: Your company’s official address can be a home, if the company secretary lives in Ireland. This address is where all the official stuff gets sent.

- Filing Registration Documentation: Important documents include the Constitution and Form A1. Hand these in to the CRO to get your company officially on the books. This is key in setting up your company in Ireland.

- Tax Registration: Sign your company up for taxes with Revenue, Ireland’s tax office. This covers Corporation Tax, VAT, and possibly Employer’s PAYE.

- Opening a Business Bank Account: Finally, open a bank account for your company. This keeps your personal and business money separate and helps prove your company is real.

By following these steps, you’re on your way to successfully starting your company in Ireland. Being properly set up means your business is its own legal being, which is great for legality and safety.

Company Structures Available in Ireland

Ireland has many types of company structures for different business needs. Designated Activity Companies (DACs) and Public Limited Companies (PLCs) are very important. Each one has its own special features. They match different goals, money levels, and rules. This makes picking the right structure very crucial.

Designated Activity Company (DAC)

DACs are for businesses that do certain tasks. They are not like PLCs. DACs have a clear purpose written in their rules. This tells investors what the company does. Firms like banks or those under strict rules often pick DACs. DACs Limited by Guarantee are good for charities. They focus on special projects without needing to have shares.

Public Limited Company (PLC)

PLCs are for businesses wanting to get money from the public on the stock exchange. They can sell shares to people. This can bring in a lot of money. But, PLCs must follow strict rules and be very open. This helps build trust with investors. PLCs are great for big businesses looking for lots of public money.

There’s also the Company Limited by Guarantee (CLG) in Ireland. It’s mainly for non-profit goals. CLGs work for their members or for certain good causes. They don’t rely on shares.

The Role of Directors and Shareholders

In Ireland, the rules for corporate governance are clear. Directors have big jobs to do. They make sure the company meets legal and financial rules. They also look after shareholder interests.

Shareholders own part of the company. Their choices shape the company’s path and they get part of the profits. They vote on big issues, like who will direct the company.

It’s important for directors and shareholders to work well together. This balance helps companies do well. Directors need to be smart about leading and following rules. Shareholders make sure the company aims for long-term success.

To wrap up, both directors and shareholders are key to good business in Ireland. They help keep companies honest and successful.

Importance of a Registered Office Address in Ireland

A business’s registered office address in Ireland plays a key role. It’s more than just a mailing point; it serves as the central hub for all formal paperwork and communication.

It’s vital to pick a suitable Irish registered business address for legal compliance. This address receives all key mails from bodies like the Revenue Commissioners and the Companies Registration Office. It’s crucial for keeping up with legal obligations.

Interestingly, this address can even be a home if managed by someone living in Ireland. This is great news for small companies or new ventures looking to save on office space.

Choosing the right address also boosts your business’s image. It shows you’re serious and reliable to anyone watching: customers, partners, and regulators.

To wrap up, selecting the right Irish registered business address is necessary. It ensures you meet all statutory compliance Ireland asks for, smoothing the way for your business to thrive within Irish laws.

Cons of Establishing a Company in Ireland

Setting up a company in Ireland has its downsides, even with a good business environment. Knowing these negatives helps in decision-making.

High Operational Costs

Starting a business in Ireland comes with high costs. It’s one of the priciest places in the EU for labour and property costs. These high expenses, along with tough permit rules, mean businesses face big overheads.

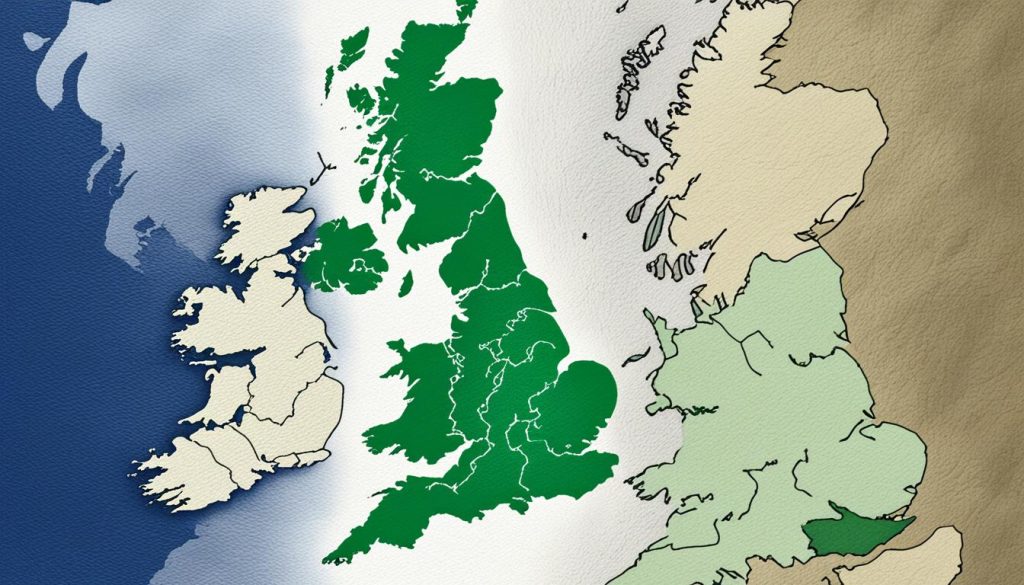

Brexit Implications

Brexit has big effects on Ireland. Ireland and the UK are close economically, making Brexit a source of complications and unpredictability. Many firms struggle to deal with these changes.

Long-Term Competitiveness

For long-term success and competitiveness, external factors are very influential. With markets focusing on certain areas, there’s a push for diversification. This helps lower the risks. Understanding these long-term factors is key to tackling Irish business challenges.

Importance of a Registered Office Address in Ireland

Having a registered office address in Ireland is vital for businesses. It’s not just a bureaucratic need. It’s a key to efficiency and legal duties.

Firstly, it links the company with authorities for all important mails. This includes legal and government notes. It’s crucial for keeping things clear and responsible.

Secondly, a proper address boosts the company’s image. It shows stability, attracting clients and investors. It’s important for strong business bonds and getting investments.

The Irish laws need companies to keep records like the register of members at this office. It helps manage things better and follows Irish law. But, it’s vital to manage this office well to avoid legal issues.

- Communication Hub: A registered office address in Ireland is key for talking smoothly with official bodies.

- Enhanced Credibility: It shows the company is serious and reliable to people involved.

- Legal Compliance: It’s needed for keeping necessary records and following Irish rules.

To enter the Irish market, knowing the value of a registered office address is key. It strengthens the company’s base, fits into Ireland’s law, and builds a good image.

Business Environment and Legal Framework in Ireland

Ireland is known for its supportive business setting. It is a top choice for entrepreneurs. Its strong legal structure helps companies work smoothly in different sectors. The country also has a solid regulatory system. This system helps businesses follow Irish laws with ease and trust.

A key feature of Ireland’s business world is its clear legal system. This system makes processes easier for companies starting in Ireland. It gives them security. This means companies can grow without worrying about legal issues.

What’s more, Ireland’s legal system meets international business standards. This makes Ireland attractive to foreign investors looking for a stable and predictable legal setting. Ireland’s high legal standards also support its economy’s stability and growth.

Ireland offers effective ways to solve business disputes. Its legal framework allows businesses to resolve conflicts quickly. This saves time and keeps good relationships with clients and partners.

Ireland blends a supportive business climate with a strong legal structure. This mix makes Ireland an ideal spot for businesses to succeed. Its welcoming environment draws more companies to establish there.

Potential Legal Challenges in Ireland

Setting up a company in Ireland has big benefits. However, you need to face potential legal challenges to protect your business interests. For many companies, knowing the legal environment is key to steer clear of trouble. Let’s explore some hurdles you might encounter.

Intellectual property rights pose one common challenge. It’s crucial to protect your trademarks, patents, and copyrights well. This prevents costly legal battles and loss of reputation. Companies should register their intellectual property to avoid disputes later on.

Following Irish employment laws is another important aspect. These laws cover employee contracts, working hours, and minimum wage. To avoid legal issues and treat your staff fairly, it’s vital to keep up with these rules.

The General Data Protection Regulation (GDPR) is all about data protection. Firms dealing with personal data must protect it. Not following GDPR can lead to big fines and damage your reputation. It’s very important for businesses to follow these rules closely.

Tax laws also offer a serious challenge. Companies must follow the rules on corporate tax and VAT. Getting advice from a tax expert is often wise to deal with these complex issues.

To sum up, starting a business in Ireland offers many advantages. But it’s crucial to know about legal challenges. Being prepared is key to success and stability in the business world.</ viagra at walmart

Investment Opportunities for Foreign Companies

Investment prospects in Ireland are on the rise for foreign businesses. This makes Ireland a magnet for global ventures. Its economic strength offers many benefits for expanding operations. Top perks include a favourable tax system and solid support for R&D.

Many sectors hold rich potential for foreign companies. These range from technology to pharmaceuticals and financial services. Leading tech companies like Google, Facebook, and Apple exemplify Ireland’s vibrant tech scene. The country’s location also makes it a portal to the European market, boosting its attractiveness.

The pharmaceutical and biomedical fields are ripe with opportunities too. Giants like Pfizer and Johnson & Johnson thrive here, thanks to a talented workforce and a culture that embraces innovation. The available government incentives and grants make it easier for foreign investors to grow their businesses.

- Technology sector growth

- Pharmaceutical and biomedical advancements

- Government incentives and grants

- Access to the European market

The financial services sector in Ireland is booming, drawing in global giants such as Citibank and JPMorgan Chase. It benefits from a well-regulated financial system and a pool of skilled professionals. Investing here means tapping into significant rewards. Ireland’s role as a leading business centre in Europe keeps investment opportunities for foreign firms strong and appealing.

Pros of Setting Up a Business in Ireland

Starting a business in Ireland offers great benefits for both entrepreneurs and investors. The country has a very appealing corporate tax rate at 12.5%, one of Europe’s lowest. This means businesses can enjoy more of their profits.

Ireland prevents companies from paying tax twice on the same income. This is through double tax treaties with over 70 countries. It’s a major plus for multinational companies.

Ireland’s workforce is highly skilled, especially in tech, finance, and pharmaceuticals. This talented pool drives growth and innovation.

The Irish legal system is clear and protective of businesses. It’s based on common law, just like the UK. This ensures a secure and predictable business environment.

Being in the European Union, Ireland lets businesses trade freely across other EU states. It’s perfectly positioned for access to major European markets. This boosts its standing as a key business location.

Ireland is known for its top-notch infrastructure and connectivity. Cities like Dublin offer good links to the world. Companies benefit from fast and reliable internet, vital for the digital age.

To conclude, Ireland is a prime location for setting up a business. It offers tax benefits, a skilled workforce, legal security, and excellent connections. It’s attractive to entrepreneurs and big companies alike.

Comparisons with Other Jurisdictions

Entrepreneurs often weigh up Ireland against other places when setting up a company. There are many factors to consider in this decision. It’s important to grasp the subtle differences between each option.

One key area to look at is the tax situation. Ireland attracts notice with its low corporate tax, unlike some European countries with higher taxes. This is a big plus for businesses wanting to save money. On top of that, Ireland’s wide tax treaty network helps avoid being taxed twice, a big bonus over places without such agreements.